Here you might double faucet to the credit we would like to generate a default and you may press ‘set since the standard card’. Yahoo Shell out ‘s the means you can utilize your smartphone or Don Operating system view and then make repayments quickly, easily and you will without the need to fumble around for your own bag or bag when you are stood at the checkout. Pursue online lets you control your Pursue accounts, consider statements, display screen activity, pay the bills otherwise import money securely from a single main lay. For questions otherwise issues, excite contact Chase customer service or let us know from the Chase issues and you will opinions.

- And when you begin to spend with your mobile phone as well, you’ll forget it was ever before needed to hold your bag or rifle as a result of percentage cards inside a shop or restaurant.

- Here are a few where you can have fun with Bing Shell out – and you may and therefore commission services come – by the region on the Bing website⁴.

- Their payment is done if you see Complete and a great checkmark for the screen.

- Just drive to your in addition to check in the base-proper and will also be brought to prefer a card.

- Apple delivered Apple Pay in the 2014, that have support to your new iphone very first.

Reel Strike no deposit | Benefits of using a cellular Handbag

They uses biometric screening tech Reel Strike no deposit entitled Deal with ID or Reach ID, you can also play with an excellent passcode to view the newest purse. Contain any debit otherwise mastercard in addition to Fruit Dollars, boarding passes, experience passes, gift cards and much more to your bag. Fruit Shell out are widely accepted during the stores and you may eating inside the community. Samsung Pay’s Favourite Cards element allows you to alter between borrowing from the bank cards prior to making money from the mobile phone. Just swipe up in the bottom of your own cellular phone’s display screen to gain access to your favorite Notes and choose the brand new cards you’d need to fool around with for your next Samsung Shell out pick.

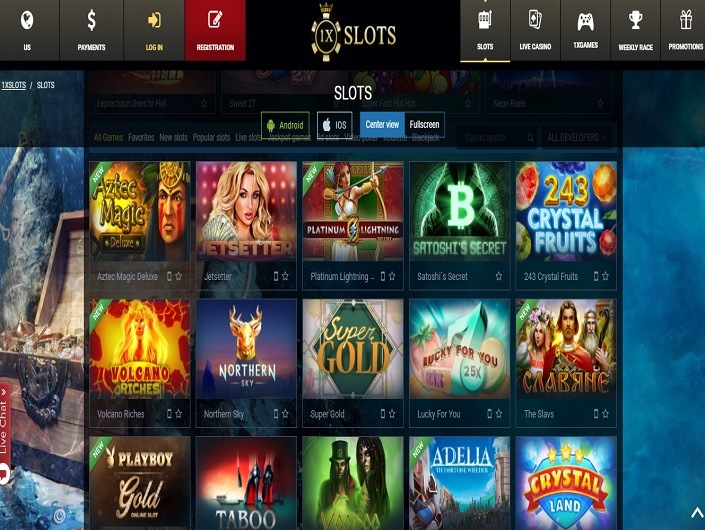

Entertainment

It’s served for the several of Samsung’s latest flagship cellphones, for instance the Universe S9, however for the other brand name’s devices, limiting more widespread adoption. The new Samsung Spend application links to borrowing and you can debit notes away from plenty of major banks. The fresh Android os cellular percentage application is Bing Shell out which comes preloaded to the Android cellphones.

A good Housekeeping participates in almost any affiliate marketing programs, which means that we could possibly get paid profits on the editorially chosen points ordered thanks to our very own website links so you can store web sites. You will must make certain your credit, thus choose whether or not to provides a confirmation code emailed for you, otherwise delivered to their cell phone as the a text. If you currently have a compatible cards linked to your Android membership, you can just approve it to have Bing Spend right here. If the card isn’t linked, just force to your ‘add a card button’.

Allow so it for the kids, establish a family group Discussing Class through Fruit or Loved ones Hook up in the Bing. To take action inside an actual physical shop, you can use one contactless critical. At the checkout, open your own cellular telephone which have a good passcode, Contact ID, otherwise Face ID, and you will faucet their Fruit unit for the terminal to expend. To prepare Apple Pay on the an iphone 3gs, open Setup, following like Handbag & Fruit Pay. From here, you might hook their borrowing or debit cards on the cellular phone’s commission system. What’s more, it allows you to include the newest cards and change the important points out of current of them.

Following that, you’ll must pursue people verification encourages you can make sure your label. Once your cards info were affirmed, you could set it up as your default percentage means inside app if you undertake. Without a doubt electronic purses, consumers might be able to put the cards from right in this the capital One Mobile application. Spending merchants with only their cell phone is straightforward once you get install. More often than not your’ll fool around with a fees terminal otherwise card reader just as your you are going to to possess a physical or contactless card percentage.

Simultaneously, their cellular phone might require an upgraded kind of the operating systems to play with contactless money. For many who’re also having difficulty delivering faucet-to-shell out to work, you may need to upgrade in order to a more recent variation. Utilizing your cellular telephone to expend in store otherwise make repayments on the web is fairly simple, however, there are several tips take in order to install faucet-to-pay in your cell phone for the first time. To set up your own commission tips, you ought to go into the Fitbit software on your cellular phone, tap their avatar (greatest right), and then tap the system that you like to prepare.

Yahoo Shell out is quite similar however, is made from the Yahoo and you can permits users from both Android or ios phones, tablets otherwise watches to make contactless purchases. Much like Apple Shell out, you can far more to this handbag than simply credit or debit notes. Google Spend lets you place a standard credit card to use when designing payments. If you would like shell out with another cards, open your own Bing Pay application and you will swipe during your offered cards if you do not get the one to we would like to have fun with. Then, keep your own cellular telephone along side bank card viewer to really make the percentage.

Using with your cellular phone work in the same manner, it’s that the financing credit data is stored on the a good cellular telephone app instead of a piece of plastic. Knowing how to utilize your bank card on your cellular telephone is also build searching more convenient and maintain you against being forced to build exposure to the newest credit critical. Unlike needing to dig a charge card from your own handbag, you can simply open your mobile phone and you will hold it along the contactless mastercard audience. Faucet to invest is an easy and you may safer way to build in-people sales, and you can contactless money could be more secure than just having fun with an elementary charge card viewer. When you’lso are install to utilize your smart phone while the an installment strategy, everything you’ll should do try open your cellular telephone, and you can wait nearby the supplier’s payment critical otherwise credit audience.

You have to know using a cards which can along with earn rewards for the almost every other purchase classes you frequently invest in the. While this yes is not the flashiest card on the checklist, it’s simple to fool around with across the sales — including your month-to-month mobile statement. To include a comparable cards or cards to the Apple Observe, make use of the Check out app. This can render their wearable a comparable power since your actual cards, you’ll manage to shell out along with your smartwatch even though your new iphone 4 isn’t close. It is because the deficiency of assistance for NFC having PayPal’s application, and just a few stores moving to the train in order to accept PayPal features hampered work so far. As the contactless fee networks remain rolled away, we’re going to help you choose the best mobile programs and you can NFC system which can meet your needs.

View the Chase People Reinvestment Act Public File for the financial institution’s current CRA rating or other CRA-associated advice. There are two main drawbacks to presenting digital wallets as opposed to bucks or a physical card. That’s where a new sequence out of amounts, entitled an excellent token, is done regarding you to-day deal. It token masks the bank card information and so the seller will not assemble they plus the whole transaction is meant to are nevertheless secure. Because the a new token is established per the brand new transaction, it can help to safeguard your details. After you’ve establish your own Electronic Handbag and also have picked your default fee approach, all you need to manage is actually can shell out.